Why invest in PRS in Dublin.

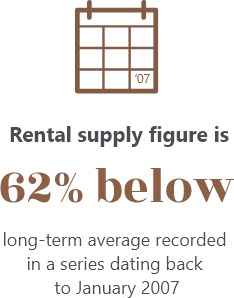

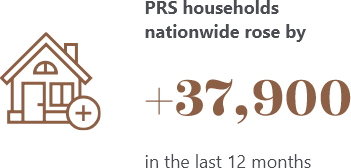

Near-record Low Supply

Minimal Vacancy

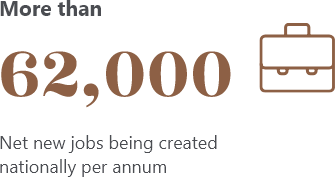

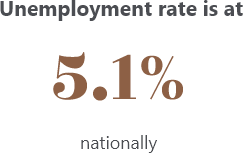

Strong Labour Market

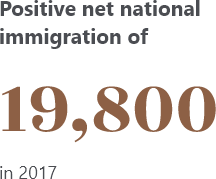

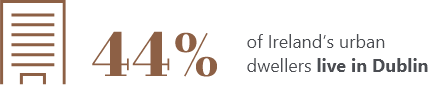

Continued Population Growth

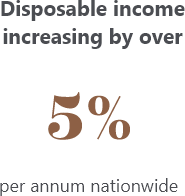

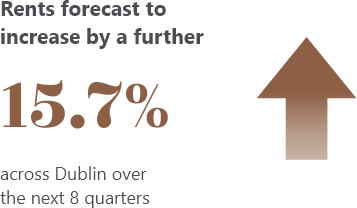

Excellent Growth Prospects

New capacity under construction in the South Docklands

The Docklands Opportunity.

Dublin’s premier business and technology district

The South Docklands is a vibrant city quarter just fifteen minutes from St Stephen’s Green and is home to a number of well-known companies including Accenture, Airbnb, BNY Mellon, BOI, Facebook, Google, HSBC, LogMeIn, Matheson, State Street and TripAdvisor.

Total stock of purpose built office accommodation in the South Docklands stood at 243,737 sq m (accommodating approximately 20,000 employees) at the end of Q1 2018. In contrast, there are approximately 2,500 units of existing residential accommodation.

Attractive workplace for foreign nationals

Ireland is the only English-speaking country in the Eurozone. As such global multinationals, including Google, Airbnb and Facebook, have located their European Headquarters here. This dynamic draws in employees from across Europe and further afield.

According to Owen Reilly …

“71% of households in the Docklands are privately rented, with 91% of new tenancies in 2017 being non-nationals”

A Smart Location

The Docklands is the ‘living lab’ for Dublin City Council’s investment in ‘smart city’ facilities. This offers residents the ability to enjoy new advances in lighting, Wi-Fi, integrated transport systems and live data on

items such as the availability of car parking spaces, urban car-sharing and free city bike schemes. The planned Trinity College Grand Canal Innovation District, a €1 billion technology and innovation campus in Grand Canal Dock, will attract investment and further enhance this city quarter for start-ups and global businesses.

Strong office development pipeline

A number of high profile mixed-use schemes are scheduled to complete in 2018 and 2019, including 5 Hanover Quay, Capital Dock, The Reflector and the adjoining 76 Sir John Rogerson’s Quay. Some 129,824 sq m of net additional office accommodation is due to be delivered in the South Docklands area by the end of 2020, of which 52% is pre-let.

Undersupply of PRS

While the pipeline of net new office development in the area has the potential to accommodate over 11,000 additional office-based workers, just 665 new residential units, including the Benson Building, are currently in the pre-planning, planning or construction phase. Such new schemes, listed below, will help alleviate only some of the pent-up demand for residential accommodation in the South Docklands.

- 6 Hanover Quay – 120 unit (on site)

- Capital Dock – 190 units (on site)

- The Reflector – 40 units (on site)

- Boland’s Quay – 46 units (on site)

- An Post Cardiff Lane – 56 units (on site)

- Lime Street – 134 units (in planning)

- 2 Cardiff lane – 7 units (planning granted)

Strong Rental Growth

According to Owen Reilly, the Docklands experienced strong annual rental growth of 10.8% in 2017. Rents in the area continue to increase, with growth averaging approximately 5% over the first six months of 2018, and renewal rates are running at 85%. Cumulatively, this represents stronger average rental growth than that of the Dublin market as a whole and demonstrates the demand for private rented accommodation in this neighbourhood.